Actionable Strategies for Effectively Managing Debt During Furlough

Actionable Strategies for Effectively Managing Debt During Furlough

The COVID-19 pandemic has profoundly affected the UK economy, leading to significant furloughs and layoffs across numerous sectors. Many individuals now face daunting financial challenges, grappling with the pressures of existing debts while their income levels have been drastically reduced. If you are among those furloughed for an extended period, navigating your debts may appear overwhelming, especially as you receive only 80% of your regular salary. However, it is entirely possible to traverse this challenging financial landscape by implementing effective strategies for managing and reducing your debt burden. Here’s how you can take proactive steps to regain control over your financial wellbeing during this critical time and work towards achieving stability.

1. Develop a Tailored Monthly Budget Reflecting Your Current Income

Start by creating a revised monthly budget that accurately reflects your present financial circumstances. This budget should incorporate your lower income while emphasizing your capacity to save effectively. Reevaluate your spending patterns and consider redirecting funds from non-essential expenses, such as entertainment, dining out, and luxury items, toward your essential bills and savings. By prioritizing your financial obligations and cutting back on discretionary spending, you can establish a sustainable budget that allows you to manage your debts more effectively while also preparing for any potential future financial challenges. This disciplined approach will not only help you stay afloat but also empower you to build a stronger financial foundation.

2. Identify Additional Income Sources to Compensate for the 20% Pay Reduction

To meet your debt repayment responsibilities, it’s crucial to explore ways to make up for the 20% salary shortfall. Investigate alternative income avenues, such as freelance work or part-time jobs, and think about trimming your expenses by canceling seldom-used subscription services or reassessing your grocery shopping habits. Implementing a cost-effective meal plan can significantly reduce your monthly outlays. By actively pursuing these savings and additional income opportunities, you will be in a better position to honor your debt commitments and avoid falling behind during your furlough period. Maintaining financial flexibility during this time is essential for achieving long-term stability.

3. Explore Debt Consolidation Loans to Streamline Your Payments

Consider the option of applying for debt consolidation loans for bad credit. These financial products can help simplify your obligations by consolidating multiple debts into a single manageable monthly payment. This approach can minimize confusion regarding due dates and payment amounts, making financial planning much easier. For individuals who are furloughed, a <a href="https://limitsofstrategy.com/debt-consolidation-loan-calculator-for-effective-budgeting/">debt consolidation loan</a> can offer a structured method for coping with limited income while alleviating the stress of juggling various payments, ultimately assisting you in regaining your financial footing and achieving peace of mind.

4. Strategically Plan for Your Long-Term Financial Goals and Security

As you navigate your financial situation, take some time to consider your long-term aspirations, such as homeownership or entrepreneurship. Establishing these future objectives can be a powerful motivator to enhance your financial wellbeing. A debt consolidation loan can also play a significant role in improving your credit score, making it easier for you to qualify for favorable mortgage or business loan terms down the line. By planning thoughtfully and working diligently toward your financial goals, you can position yourself for success and gain greater financial independence as you progress into the future.

For further assistance and expert advice on managing your finances during the pandemic, and to learn how debt consolidation loans can specifically benefit furloughed employees, reach out to Debt Consolidation Loans today. Our team of professionals is ready to help you navigate this challenging time and find the best solutions tailored to your unique needs.

If you are a homeowner or business owner, connect with the experts at Debt Consolidation Loans today to discover how a debt consolidation loan can positively influence your financial health and stability.

If you believe a Debt Consolidation Loan aligns with your financial objectives, don’t hesitate to contact us or call 0333 577 5626. Take the essential first step toward improving your financial situation with a single, manageable monthly repayment.

Discover Essential Financial Resources for Expert Guidance and Support:

Consolidate My Medical Loan: Is It Possible?

Consolidate My Medical Loan: Is It Possible?

Is It Possible to Successfully Consolidate Your Medical Loan?

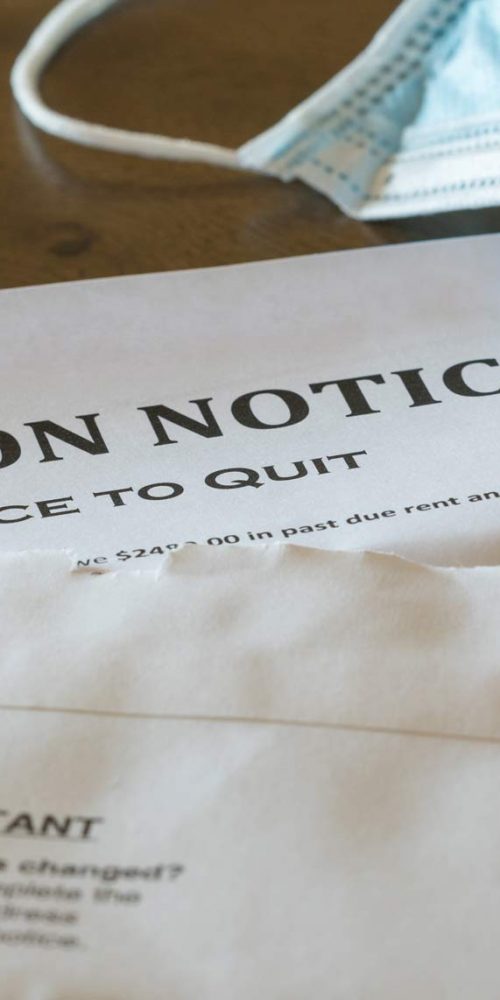

Evictions Delayed Until March, Car Seizures Still Allowed

Evictions Delayed Until March, Car Seizures Still Allowed

Evictions Postponed Until March: Essential Information You Must Know

Get Out of Debt Quickly: Effective Strategies to Consider

Get Out of Debt Quickly: Effective Strategies to Consider

Quick and Effective Strategies to Escape Debt Successfully

Debt Consolidation Loans UK: Benefits and Drawbacks

Debt Consolidation Loans UK: Benefits and Drawbacks

Understanding the Benefits and Drawbacks of Debt Consolidation Loans in the UK

Debt Consolidation Loan Calculator for Smart Financial Planning

Debt Consolidation Loan Calculator for Smart Financial Planning

Utilize Our Debt Consolidation Loan Calculator for Effective Financial Planning

The Article Furloughed and in Debt? Key Actions You Must Take Was Found On <a href="https://limitsofstrategy

Comments are closed

Your post touches on such a crucial topic, especially in recent times when many of us have faced unexpected financial hurdles. The suggestion to develop a tailored monthly budget based on current income is particularly resonant. When I was furloughed, I found that breaking down my expenses into essential and non-essential categories was eye-opening. It helped me understand where I could cut back without sacrificing my wellbeing.